In research done by Amplifinity, they found that verbal referrals produced the best results with a 32% success rate. If you’re not used to requesting referrals, make it a habit, most appropriately after completing a service. To encourage your customers, you can even make a referral program which offers discounts or gift checks.

Using break-even analysis to determine level of production

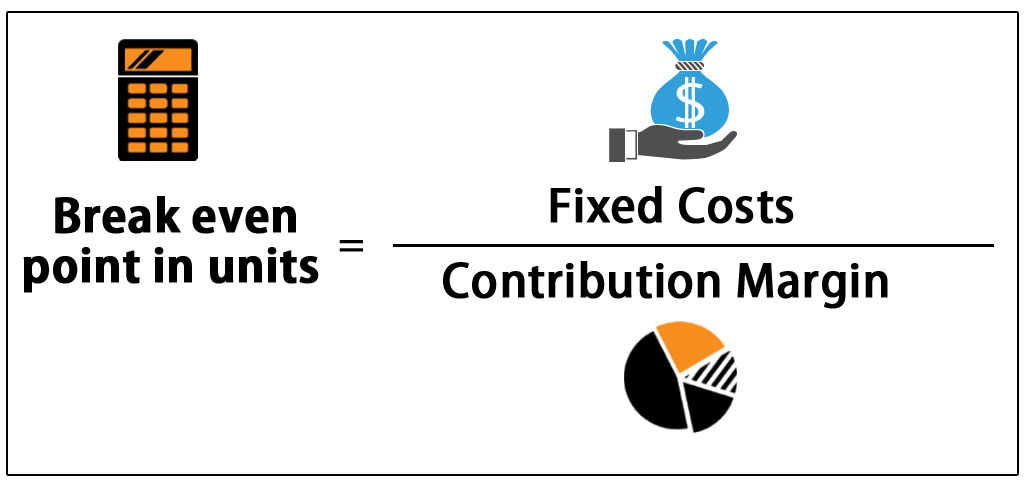

This is the amount each unit contributes to paying off fixed costs and increasing profits, and it’s the denominator of the break-even analysis formula. To find self assessment income and expense tracker spreadsheet it, subtract variable costs per unit from sales price per unit. There are two main business factors that impact BPE, these are fixed costs and variable costs.

Assumes constant selling prices

- Try to push for lower rates, especially if you’ve been working with them for many years.

- Outsourcing these nonessential costs will lower your profit margin and require you to sell fewer products to make a profit.

- In this case, you estimate how many units you need to sell, before you can start having actual profit.

- It’s also important to check your competitor’s prices and any unique features to their products.

- It is that point of time when your business has generated enough revenue to cover your initial cost.

- Compare cost, overheads and business factors again return to calculate your break even point when selling multiple items/products.

This $40 reflects the revenue collected to cover the remaining fixed costs, which are excluded when figuring the contribution margin. Break-even analysis looks at fixed costs relative to the profit earned by each additional unit produced and sold. You might want to add new products to sell to reach the break even point. This can be particularly useful if you are considering break even from an overall business perspective.

How to Calculate the Break-Even Interest Rate on Bonds

Or the business can even eliminate advertising from one period to the next. The break-even point is crucial for businesses to ensure that they are not operating at a loss. It helps you understand how much money you need to make before you start generating profits, allowing for more effective financial planning. When a company breaks even, it’s reached a point where it does not have profits or loss. This is called the break even point (BPE), when a business’s revenue is equal to its expenses. For this reason, the BPE is an indicator for the time it takes for a company to become profitable.

Don’t forget other fixed expenses such as rent, marketing, research and development, insurance, etc. Generally, when a company starts to earn is determined by how expensive the startup costs are. The larger initial capital you need upfront, the longer it will take for a company to recoup business expenses and become profitable.

What is a variable cost?

Note that your BEP will change as your sales volume for the product and the unit price changes. Upon selling 500 units, the payment of all fixed costs is complete, and the company will report a net profit or loss of $0. The Break-Even point is where your total revenue will become exactly equal to your cost. At this point the profit will be 0 and any income earned beyond that point would start adding into your profits. One business’s fixed costs could be another business’s variable cost.

In this situation, it’s best to use forecasting tools like financial projections or budgeting software to account for future expenses and revenue growth. If you won’t be able to reach the break-even point based on the current price, it may be an indicator that you need to increase it. For example, if you raise the price of a product, you’d have to sell fewer items, but it might be harder to attract buyers. You can lower the price, but would then need to sell more of a product to break even. It can also hint at whether it’s worth using less expensive materials to keep the cost down, or taking out a longer-term business loan to decrease monthly fixed costs. External circumstances, like trade agreements and changes in the political climate, have an impact on your sales.

So, your break even plan will form your datum point at which you become profitable. Achieving 5% may well be the disired growth rate to allow the business to succeed, achieving 10% or 20% would facilitate excellent business growth. Knowing this allows you to set targets for your sales teams and provide incentives for them (financial, promotion, shares etc.). The key overall factor is the visibility that the figures provide. Break-Even Analysis is important because it helps businesses understand how many units they need to sell to cover their costs and start making a profit.

Finding your break-even point gives you a better idea of which risks are really worth taking. This gives you the number of units you need to sell to cover your costs per month. Anything below this number means your business is losing money. The calculation is useful when trading in or creating a strategy to buy options or a fixed-income security product.