The Ultimate Guide to Demo Trading Forex: Strategies and Benefits

Demo trading in Forex is an essential tool for both novice and experienced traders to refine their skills and develop profitable trading strategies. With platforms like demo trading forex Trading Broker KW, aspiring traders can access virtual trading environments that simulate real market conditions without the financial risks associated with live trading. In this article, we will explore what demo trading entails, its benefits, effective strategies, and tips to maximize your experience.

What is Demo Trading in Forex?

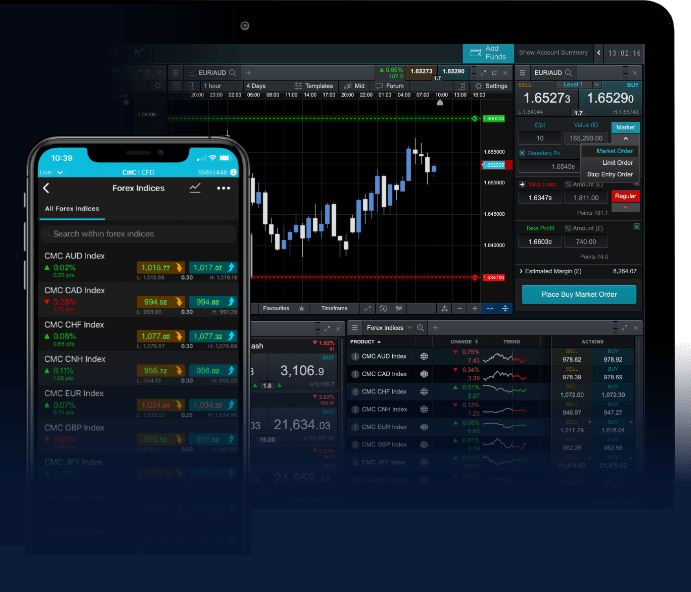

Demo trading refers to using a simulated trading account with virtual money to evaluate trading strategies and get a feel for the Forex market. Most brokers offer demo accounts as part of their services, allowing users to learn how to execute trades, understand market dynamics, and test trading platforms without risking real funds. This practice is often crucial for beginners who want to learn the basics of trading before venturing into a live account.

The Benefits of Demo Trading

There are several noteworthy benefits to engaging in demo trading, including:

- Risk-Free Environment: Traders can test strategies and make mistakes without the risk of losing real money.

- Skill Development: Demo accounts provide ample opportunities to learn about different trading instruments and develop technical analysis skills.

- Platform Familiarity: Users can become accustomed to the trading platform’s features and functionalities before committing real funds.

- Strategy Testing: Traders can experiment with various strategies and trading styles to see what works best for them before applying them in real markets.

- Confidence Building: Successfully navigating a demo account can build confidence, which is crucial when transitioning to a live account.

Getting Started with Demo Trading

Starting with demo trading is straightforward. Here’s a step-by-step guide:

- Choose a Broker: Select a reputable Forex broker that offers a demo trading account. Look for brokers that provide intuitive platforms and a wide range of currency pairs.

- Open a Demo Account: Sign up for a demo account by providing the required information. Most brokers will provide virtual funds that you can use for trading.

- Download the Trading Platform: If necessary, download the broker’s trading software or use their web-based platform.

- Start Trading: Begin trading with the virtual funds, using the knowledge you’ve gained about the Forex market and trading strategies.

Effective Strategies for Demo Trading

The goal of demo trading is to prepare for live trading, so it’s essential to adopt effective strategies during this phase. Here are some proven strategies:

1. Set Clear Goals

Before starting your demo trading journey, define what you want to achieve. Whether you aim to understand trading psychology, test a specific strategy, or build technical analysis skills, clear goals will guide your practice.

2. Trade Regularly

Treat your demo account as if it were a live account. Make it a habit to trade regularly, as this will help in developing discipline and a routine that can carry over into live trading.

3. Keep a Trading Journal

Maintaining a trading journal allows you to track your trades, analyze successes and failures, and refine your strategies. Documenting your decisions will help you learn and adapt quickly.

4. Test Different Strategies

Use this opportunity to test various trading strategies, including scalping, day trading, and swing trading. Experimenting in a risk-free environment helps you understand the advantages and drawbacks of each method.

5. Focus on Risk Management

Even when trading in a demo account, it’s crucial to implement risk management principles. Practice setting stop-loss orders and managing your position sizes, as this will be vital when you trade live.

Common Mistakes to Avoid in Demo Trading

While demo trading offers many advantages, it’s still possible to make mistakes that can hinder your learning experience. Here are common pitfalls to avoid:

- Treating It Like a Game: Many traders underestimate the seriousness of demo trading and treat it like a game. Approach your demo trading with the same seriousness as live trading.

- Neglecting Emotions: Demo trading may not always replicate the emotional pressures of live trading. Be aware that emotions play a significant role in decision-making and cultivate emotional discipline.

- Overleveraging: Just because you are using virtual funds doesn’t mean you should take excessive risks. Practice smart capital allocation as it reflects your approach in real trading.

Transitioning from Demo to Live Trading

After gaining some proficiency in a demo account, many traders wonder when it’s time to transition to live trading. Here are some indicators that you may be ready:

- You have consistently made profitable trades over a significant period.

- You have tested multiple strategies and found one that suits your trading style.

- You understand the risks involved in trading and are prepared to handle them emotionally.

Transitioning to a live account should be done carefully. Start with small amounts and gradually increase your investment as you gain confidence and experience.

Conclusion

Demo trading is a crucial step for anyone interested in Forex trading. It provides an invaluable opportunity to learn, practice, and hone trading skills without financial risk. By setting clear goals, following effective strategies, and avoiding common mistakes, you can maximize your demo trading experience. Once you feel confident and ready, make the transition to live trading with a solid foundation built through your demo trading journey. Embrace the learning process, stay disciplined, and remember that success in trading is achieved over time with persistence and practice.